most reliable mortgage lenders: how to compare your best options

What makes a lender truly reliable

Reliability blends transparent pricing, consistent underwriting, responsive support, and the capacity to close on time. Look for rate locks honored without surprise fees, clear loan estimates, and servicing that stays helpful after closing.

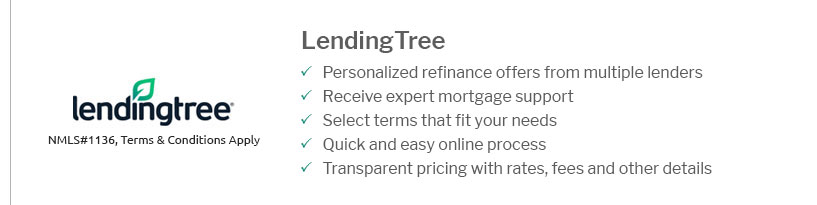

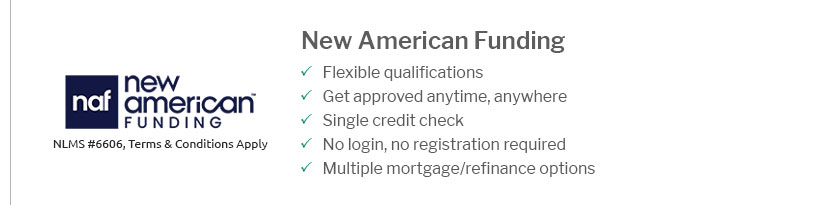

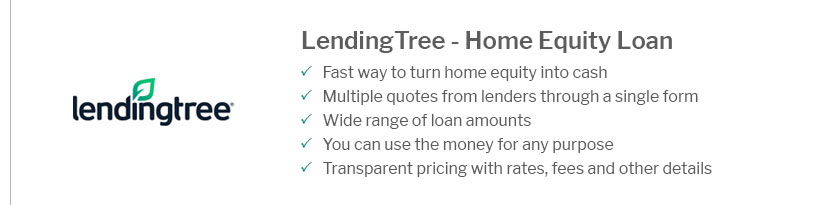

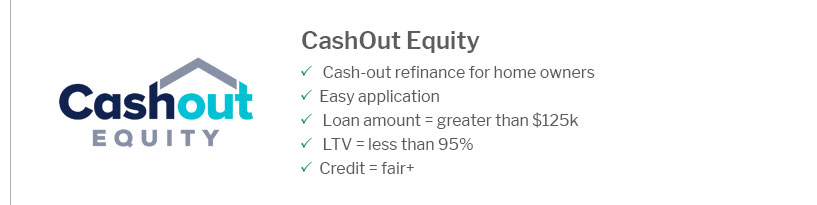

Popular options compared

Online lenders often excel at speed and digital tools, while credit unions provide member-focused service and often lower fees. National banks bring broad product menus and jumbo expertise, and community banks shine with local underwriting and personalized guidance.

- Online lenders: quick preapprovals, competitive rates; verify stability and human support.

- Credit unions: relationship pricing, flexible terms; membership limits may apply.

- National banks: wide programs, strong compliance; processes can feel rigid.

- Community banks: local insight, attentive service; narrower product sets.

Compare APR, discount points, lender fees, and lock terms across at least three quotes. Ask about underwriting turn times, appraisal management, and post-closing servicing. A reliable lender will document everything and communicate proactively, so your loan closes when your life needs it to.